No worries for refund as the money remains in investor's account." Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

Iron condor example update#

Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant.

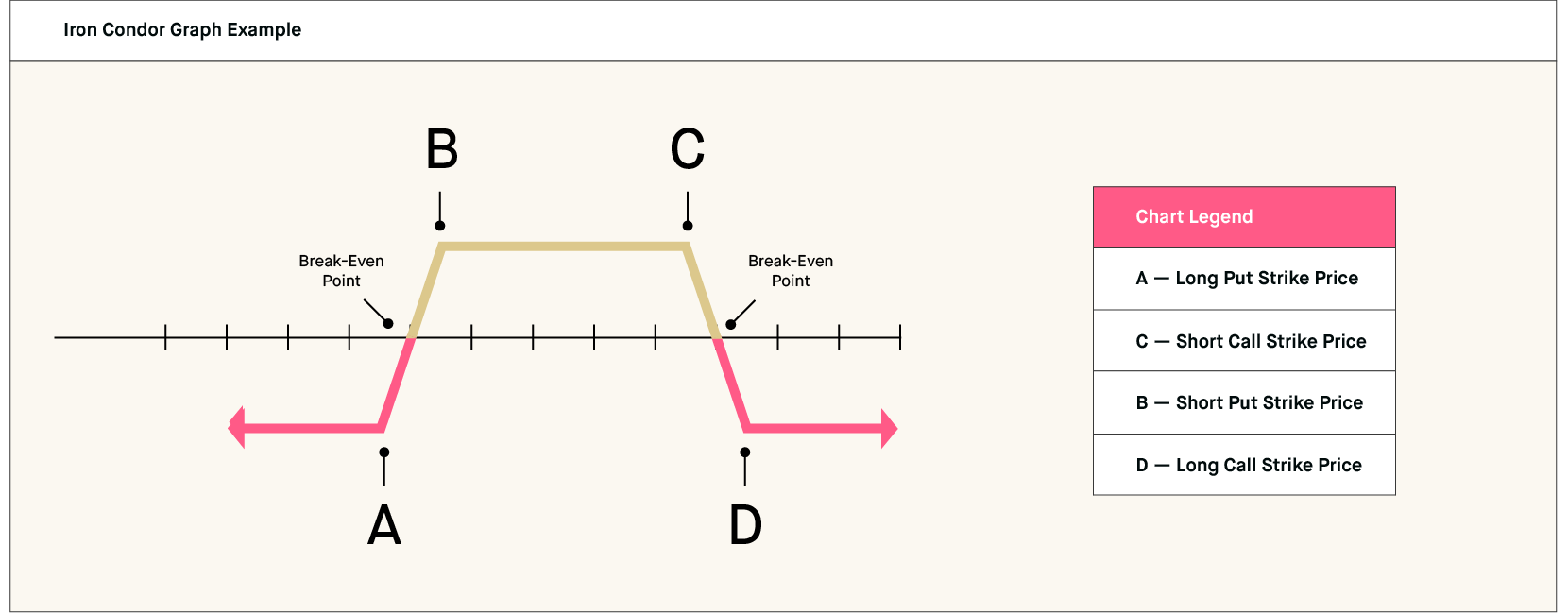

Iron condor example free#

If you are a beginner and want to trade in Options, you can open a free trading account with IIFL and start trading in Derivatives such as Futures and Options. It is always wise to consult your stock broker, such as IIFL, and discuss the strategy with experienced financial advisors. However, as the technique aims to see all four options expire worthlessly and profit from the net premium, the options strategy is one of the most complicated options strategies known to investors. Iron Condor is an effective profit-making strategy if an investor believes that the market will enter a stage of low volatility. The Iron Condor options strategy can be managed and adjusted in between to limit the loss if there is a possibility of it happening.The investors know beforehand the maximum profit they can make and how much they stand to lose.It allows options traders to manage a sideways market exhibiting low volatility and profit from market conditions.The Iron Condor Options strategy includes numerous benefits when compared to other options strategies. If not, you incur a loss depending on the price difference between the stock and the contract. If the stock price is within the specified limit, you realize profits based on the premium paid. This is how the Iron Condor options strategy works for an options trader. However, as your initial gain was Rs 80, your total loss narrows to Rs 420. Since the lot size is Rs 100, the total loss becomes Rs 500. Here, you will incur a loss of Rs 5 (Rs 20-25). The Sell Call Option will not expire worthless as it gives you the right to buy at Rs 35 instead of Rs 20.The Sell Put Option will not expire worthless as it gives you the right to sell at Rs 25 instead of Rs 20.Buy Call Option will expire worthless since it gives you the right to buy at Rs 40 instead of Rs 20.Buy Put Option will expire worthless as it gives you the right to sell at Rs 20 which is the same as the market price).Let’s say at the end of the expiry, the price of the stock is Rs 20 on expiry. Scenario 2: The stock price is below Rs 25 or higher than Rs 35. However, to understand the iron condor's meaning, you need to know the types of options and terms related to the Iron Condor options strategy. One of the most widely used is the Iron Condor options strategy. In Options Trading, the profit potential is high due to the effective trading strategies that are based on tried and true processes used by Options traders. Similarly, selling Options will reduce your losses if the security price goes down, which is also known as hedging.

Iron condor example full#

This is because you do not have to pay the full premium for the issuance of an options contract. Options can be acquired with brokers through online trading accounts as with any other asset group.Īlthough it's a little more complex than stock trading, Options yield comparatively better profits if the security price increases. Options are contracts that grant the holder the right but do not bind them, to either buy or sell a sum of some underlying asset at or before the contract expires at a fixed price. The same goes with Options trading and its numerous complex strategies. What is Dematerialization & It's ProcessĪ common belief in the Indian financial market is: the more complex the strategy, the higher is the potential for profits.Difference Between Demat and Trading Account.Documents Required to Open a Demat Account.Aims, Objectives and Importance of Demat Account.What is the Sub-broker Program of IIFL?.

0 kommentar(er)

0 kommentar(er)